SEPA Direct Debit is the backbone of recurring and account-to-account payments across Europe. It allows businesses to collect money directly from a customer’s bank account using a standardized legal and banking framework that works across more than thirty European countries. For merchants operating in the EU and UK-connected markets, SEPA is not simply another payment […]

In the opening weeks of 2026, the global trade landscape has been fundamentally reshaped by what is arguably the most aggressive use of economic statecraft in modern history. The announcement of the “Greenland Tariffs” by the U.S. administration—a strategy designed to leverage trade barriers to achieve territorial goals—has left European merchants, from boutique e-commerce owners […]

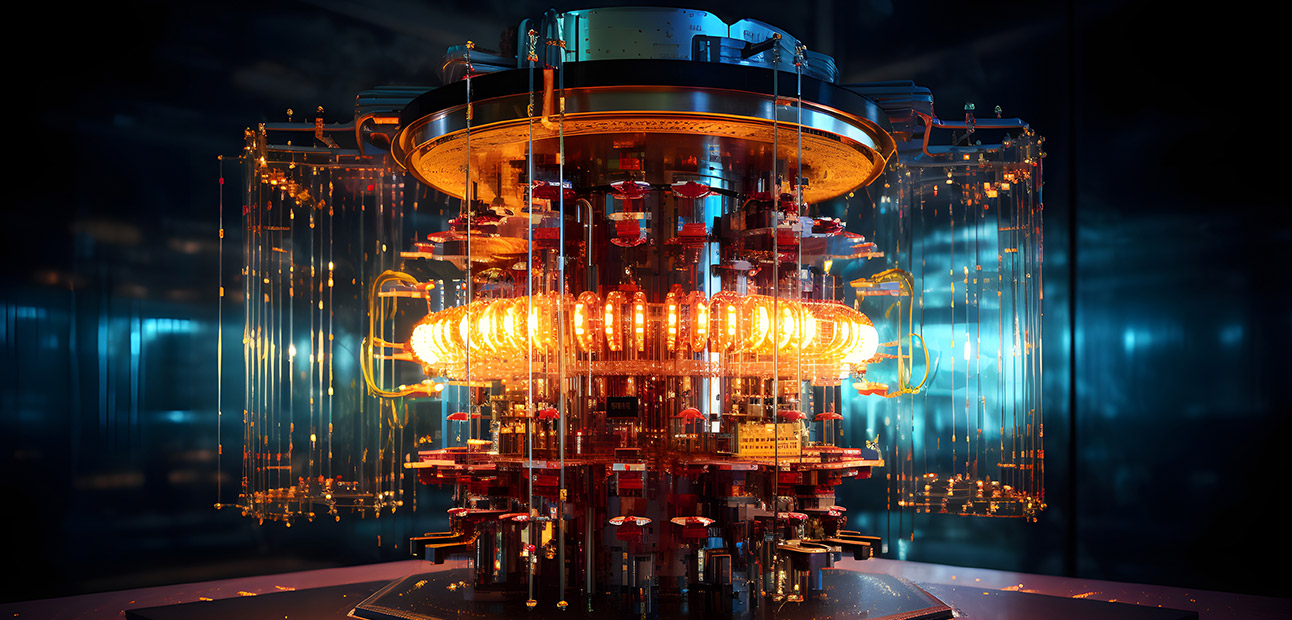

In the world of fintech and digital payments, security is not a static destination—it is a continuous evolution. For years, our industry has relied on encryption standards like RSA and Elliptic Curve Cryptography (ECC) to secure everything from online transactions and API communications to digital signatures. These technologies are the invisible bedrock of trust in […]

Beyond the currency switch: How the 2026 transition reshapes liquidity, risk, and opportunity for global merchants. On January 1, 2026, the map of the Eurozone will change once again. As Bulgaria retires the Lev (BGN) to become the 21st member of the bloc, we are witnessing more than just a ceremonial changing of the guard. […]

The End of Cloud Illusion: Why US Providers Pose an Unacceptable Compliance Risk under GDPR and DORA

A recent legal opinion, commissioned by the German Federal Ministry of the Interior and Community (BMI) and published by the University of Cologne, has provided definitive clarity on a critical, long-debated conflict: the irreconcilability of US data access laws (like the CLOUD Act) with the European Union’s fundamental rights and stringent regulatory framework. For regulated […]

The New Frontier of Financial Risk: The Tectonic Shift in European Payments The payment industry relied heavily on the Revised Payment Services Directive (PSD2) to secure transactions. While PSD2’s Strong Customer Authentication (SCA) successfully curbed unauthorized card fraud, it proved ineffective against the current threat: Authorized Push Payment (APP) fraud. Consequently, financial crime evolved. APP […]

Stablecoins are undergoing a major shift from niche crypto instruments to regulated components of modern payment infrastructure. Over the past two years, they have captured the attention of fintechs, issuers, card networks, banks, and large ecommerce players. This evolution is not driven by hype, but by the growing pressure to modernize global money movement and […]

FinTech’s Threat Landscape Has Grown Faster Than Its Defenses The last decade of FinTech innovation was defined by acceleration. Instant payments, seamless onboarding, split-second risk scoring, frictionless commerce — everything revolved around reducing time. Yet while the sector streamlined user experience, another process was unfolding behind the scenes at a pace even faster than the […]

A few years ago, most online shops were built on a simple idea: attract traffic, convert as many visitors as possible into buyers, and repeat. Revenue grew in waves, driven by campaigns, seasonality, and platform performance. That model worked reasonably well as long as advertising was cheap and competition was moderate. Today, the conditions have […]

Why Mastercard’s UAE launch marks the beginning of a structural shift in payments, governance, and market competition. A New Economic Actor Enters the Payments System The introduction of Mastercard’s Agent Pay in the UAE represents more than a milestone in payments innovation — it may be the first real example of autonomous machine actors participating […]

The payment industry enters 2026 in a phase of accelerated transformation. Consumer expectations are changing quickly, regulatory pressure is intensifying, and geopolitical tensions are reshaping global commerce. At the same time, AI, tokenisation, and embedded finance are moving from emerging concepts to industry standards. In this environment, payments are no longer a technical function in […]

In November 2025, Novalnet received a B – Gute Nachhaltigkeitsperformance rating in the ESG assessment conducted by Synesgy (CRIF). On paper, it’s a certificate. In practice, it reflects something far more important: how the company is run, how responsibly it behaves, and how much merchants can trust it as a long-term partner. In the payments […]