Tag: Novalnet

In the opening weeks of 2026, the global trade landscape has been fundamentally reshaped by what is arguably the most aggressive use of economic statecraft in modern history. The announcement of the “Greenland Tariffs” by the U.S. administration—a strategy designed to leverage trade barriers to achieve territorial goals—has left European merchants, from boutique e-commerce owners […]

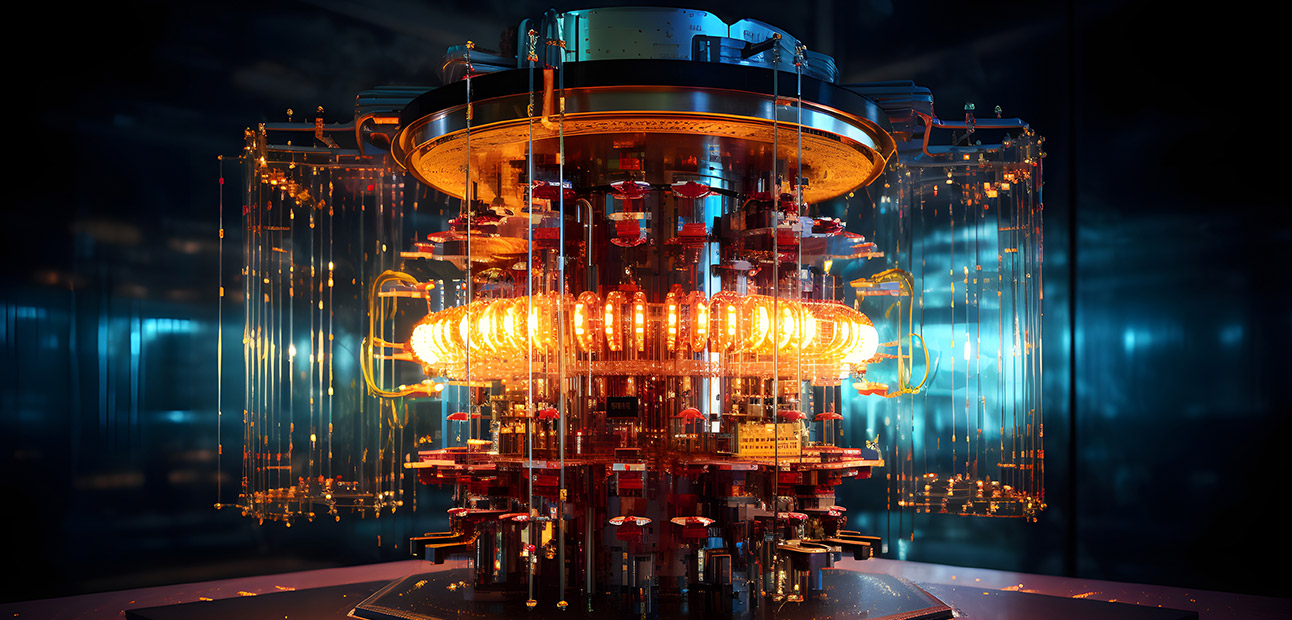

In the world of fintech and digital payments, security is not a static destination—it is a continuous evolution. For years, our industry has relied on encryption standards like RSA and Elliptic Curve Cryptography (ECC) to secure everything from online transactions and API communications to digital signatures. These technologies are the invisible bedrock of trust in […]

The End of Cloud Illusion: Why US Providers Pose an Unacceptable Compliance Risk under GDPR and DORA

A recent legal opinion, commissioned by the German Federal Ministry of the Interior and Community (BMI) and published by the University of Cologne, has provided definitive clarity on a critical, long-debated conflict: the irreconcilability of US data access laws (like the CLOUD Act) with the European Union’s fundamental rights and stringent regulatory framework. For regulated […]

FinTech’s Threat Landscape Has Grown Faster Than Its Defenses The last decade of FinTech innovation was defined by acceleration. Instant payments, seamless onboarding, split-second risk scoring, frictionless commerce — everything revolved around reducing time. Yet while the sector streamlined user experience, another process was unfolding behind the scenes at a pace even faster than the […]

Why Mastercard’s UAE launch marks the beginning of a structural shift in payments, governance, and market competition. A New Economic Actor Enters the Payments System The introduction of Mastercard’s Agent Pay in the UAE represents more than a milestone in payments innovation — it may be the first real example of autonomous machine actors participating […]

In November 2025, Novalnet received a B – Gute Nachhaltigkeitsperformance rating in the ESG assessment conducted by Synesgy (CRIF). On paper, it’s a certificate. In practice, it reflects something far more important: how the company is run, how responsibly it behaves, and how much merchants can trust it as a long-term partner. In the payments […]

Mobile commerce continues to grow at record speed — and users expect fast, seamless, and secure payment experiences inside the apps they use daily. For businesses, this means delivering a checkout flow that is not only frictionless, but also fully compliant, scalable, and easy for developers to integrate. To help iOS developers meet these rising […]

Munich, Germany – September 2025 – Novalnet, a BaFin-licensed global payment service provider, proudly announces its official go-live as a VISA acquirer and recognition as a VISA Principal Member. This milestone places Novalnet among a select group of financial institutions worldwide that hold the highest level of partnership with VISA, one of the world’s most […]

Agentic Commerce is transforming how transactions are initiated and completed—by intelligent agents, not just humans. This in-depth guide explores how AI, autonomous systems, and programmable payments are reshaping the future of commerce and payment processing, and what businesses need to do to stay ahead.

The way we move money is changing. Not overnight, and not with loud fanfare. But steadily—underneath the surface of day-to-day transactions, under the rules of regulators, and across the servers of financial infrastructure providers.

France is a country that’s both fiercely proud of its traditions and surprisingly receptive to change, the way consumers and businesses handle payments reveals a lot about how France works—and how businesses outside it can succeed within it.

From phygital experiences blending physical and digital methods to AI-powered fraud prevention and blockchain integration, discover how these trends are reshaping the payment landscape. Learn about real-time transactions, collaborative ecosystems, and global accessibility that are set to define the industry.