No CFO ever called a press conference because their payments processed flawlessly. But ask anyone in the room during a failed payout, a blocked transaction, or a cross-border refund gone wrong—and you’ll find the real cost of unreliable payments. Payment failures are widely reported in the news, whereas successful, routine operations rarely make headlines.

Payment systems are often taken for granted, especially when they work. Yet they form the backbone of revenue, reputation, and regulatory compliance. For enterprises operating across markets, the ability to move money reliably—quietly, securely, and without disruption—is not a technical detail. It’s a strategic differentiator.

The Infrastructure No One Talks About

Many companies focus on front-end UX, sometimes underestimating payment friction. It’s only when things go wrong—disputed charges, failed settlements, unexpected friction at checkout—that its importance becomes painfully clear. Payment issues are a leading cause of lost sales.

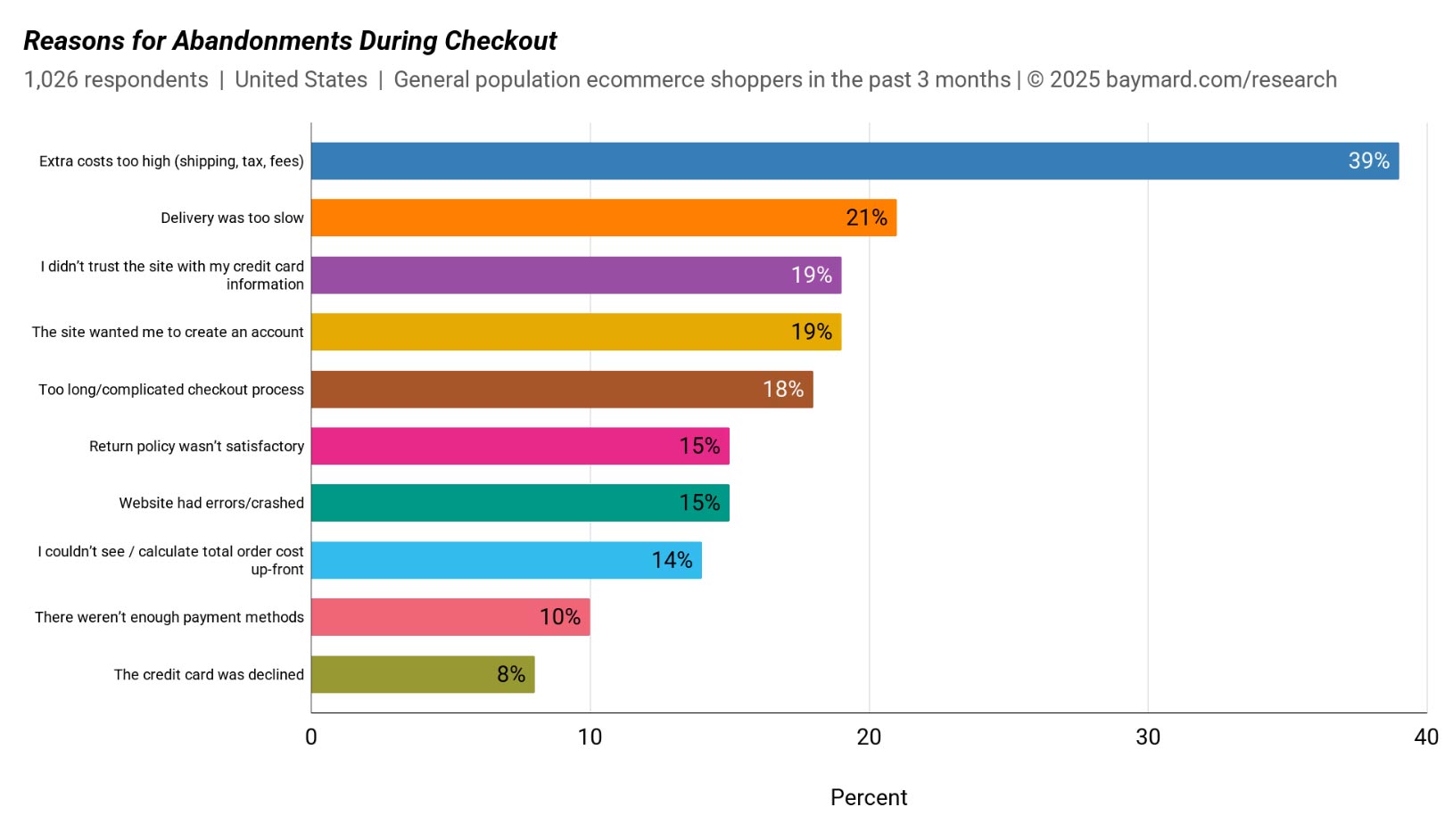

According to the Baymard Institute, 17% of all cart abandonments stem from concerns around payment security, while 6% occur simply because a customer couldn’t find their preferred payment method. Together, that’s a quarter of potential business lost to something entirely avoidable. In enterprise terms, that’s not a UX issue—it’s a revenue leak.

Chart Source: Baymard Institute

Chart Source: Baymard Institute

Why Reliability Wins in the Long Run

We often equate payment reliability with system uptime, but it goes far deeper than that. True reliability means giving customers a consistent experience whether they’re paying in euros, rupees, or dollars. It means knowing that local preferences—like Giropay in Germany or UPI in India—are available without friction. It means being confident that payments are not just processed, but processed securely and in full compliance with local and international regulations.

For internal teams, reliability shows up in how settlements are handled, how easily transactions are reconciled, and how quickly support can trace the root of a failed transaction. Novalnet’s Instant Payment Guarantee for SEPA Direct Debit, Invoice Payments, and Credit Card Payments helps ensure uninterrupted cash flow by removing the uncertainty of delayed or failed payments. These operational details might not be visible to the customer, but they are painfully visible to your finance and operations teams when things break down.

The Companies Getting It Right

The companies that set the benchmark for seamless payments don’t talk about payments at all. They don’t need to. When was the last time you had to think about how Netflix debits your account, or how Amazon handles a refund? These companies have invested heavily in building—or partnering with—payment infrastructure that works so consistently, it disappears.

Behind the scenes, they rely on scalable payment orchestration platforms that can handle multiple currencies, integrate with a range of payment providers, automate billing for subscriptions, and flag fraudulent activity before it becomes a problem. It’s not just about convenience. It’s about creating resilience.

Getting It Right from Day One

If you’re building—or rebuilding—your enterprise payment stack, treat it as you would any other critical system. Don’t optimize for what works today; build for what must not fail tomorrow.

That means choosing a partner who offers both technical strength and operational maturity. Look for global reach, strong coverage of local payment methods, fraud prevention capabilities, and tools that give your finance teams the visibility and control they need.

Final Thought

Empires aren’t built on flashy features or media buzz. They’re built on consistency, trust, and the kind of infrastructure that just works—especially when no one is watching.

Because when payments function exactly as they should, your business grows quietly, confidently, and without interruption. And that’s when you know it’s working.

Antony Robinson is an experienced IT expert, information architect and a customer experience evangelist. He has over 30 years of experience in web technologies, user experience, media, and marketing. Antony is currently the CMO of Novalnet AG, a fintech company in Germany. As CMO, he leads the company’s marketing strategy and fosters collaborations. Antony’s expertise and dedication to technology and innovation make him a valuable leader in his field.