What growing subscription-based businesses can learn from enterprise leaders in billing, churn reduction, and seamless systems integration.

The Growing Complexity of Subscription Businesses

In the early days of SaaS and service-based models, subscription management was as simple as sending an invoice every month. Not anymore.

As companies scale and expand across regions, product lines, and pricing tiers, the architecture behind subscriptions becomes more complex. From dynamic pricing and customer segmentation to global compliance and data privacy, today’s subscription engines must do far more than just process recurring payments.

For enterprises, this complexity is both a challenge and an opportunity.

Companies that master enterprise subscription management solutions aren’t just improving operational efficiency—they’re driving retention, boosting revenue, and delivering richer customer experiences. So how are today’s leading SaaS and service providers doing it?

Let’s dive into some of the key lessons.

Lesson 1: Treat Recurring Billing as a Growth Lever—Not Just an Operational Need

Many companies still view recurring billing as a back-office task, a function of finance and automation. But at scale, billing becomes a key part of your customer experience.

Take Salesforce, for example. The way they bill is tightly integrated with how customers consume their product—monthly usage, feature access, user seats. The billing cycle is designed to reflect value, not just charge a fee.

This shift—from seeing billing as a transaction to treating it as an extension of the product—transforms how companies build trust and loyalty.

Why it matters: When billing aligns with customer expectations and product value, disputes decrease, satisfaction improves, and revenue becomes more predictable.

Lesson 2: Churn Isn’t Always About the Product

When a customer cancels, it’s easy to assume the product wasn’t good enough. But in reality, a poor subscription experience can cause just as much churn as a weak product.

Failed payments. Confusing invoices. Inability to pause or modify a subscription. These are all operational issues that lead customers to silently walk away.

Netflix has long been admired for its low churn, and it’s not just about content. Their subscription controls are intuitive. Payment retries are automated but unobtrusive. And users can upgrade, downgrade, or cancel without needing to call a human being.

If you’re wondering how to reduce churn in SaaS billing, start by auditing every customer touchpoint related to subscriptions.

Are invoices clear? Are failed payments handled gracefully? Can customers manage their subscriptions easily? If not, the churn isn’t a mystery—it’s baked into the experience.

Lesson 3: Compliance Is Not Optional—It’s a Competitive Advantage

In a global business environment, compliance goes far beyond taxes and data storage.

For example, in the EU, PSD2 regulations mandate Strong Customer Authentication (SCA), which directly impacts how recurring payments are processed. If your billing platform doesn’t support SCA-compliant flows, you risk failed transactions—and eventually, lost customers.

Meanwhile, data privacy laws like GDPR and CCPA require transparency in how customer data is stored and used. Subscription data is sensitive—it contains not only payment info but also usage patterns and preferences.

Enterprise providers like Adobe and Microsoft invest heavily in compliance because it builds trust—and trust converts.

Smart move: Work with a subscription platform that bakes compliance into its core, not as a bolt-on.

Lesson 4: Deep Integration Is the New Automation

The best subscription businesses don’t just automate processes—they deeply integrate them.

Subscription data doesn’t live in a silo. It connects to your ERP, your CRM, your analytics stack, and your customer support system.

Let’s say a customer calls in with a billing question. If your support team has to toggle through multiple systems to find the answer, that’s a poor experience. But if your subscription platform is integrated into your CRM, the agent can pull up the exact invoice, usage record, and account history—in seconds.

Zendesk does this well. By integrating billing and usage insights into their support platform, they solve problems faster and reduce friction.

Enterprise subscription management solutions should act as the connective tissue across departments. When billing, sales, marketing, and support all pull from the same source of truth, customers feel the difference.

Lesson 5: Enterprise Needs Are Different—Don’t Settle for a One-Size-Fits-All Tool

What works for a 50-user startup won’t cut it at scale. Enterprises need:

-

Multi-currency support

-

Tiered billing models

-

Localization for taxes and languages

-

Sophisticated user permissions

-

Audit trails and compliance documentation

-

High availability and uptime guarantees

Stripe and Chargebee have grown by offering enterprise-grade subscription solutions tailored for this complexity. But even they rely on strategic partnerships with payment service providers who bring local expertise, integrations, and regulatory know-how.

At Novalnet, we work closely with our clients to tailor subscription systems for scale—not just technically, but legally, operationally, and culturally.

What’s Next for Subscription Models?

The future of subscriptions isn’t just recurring revenue—it’s relationship-based revenue.

Customers are increasingly looking for flexibility, transparency, and personalization. This means businesses must rethink how they structure not just pricing but also the experience of subscribing.

AI-powered billing, real-time usage analytics, and predictive churn models are already being explored by forward-thinking teams. But the foundation is still the same: clear, compliant, connected systems that put the customer at the center.

If you’re scaling your subscription business, don’t wait for problems to appear. Design your systems as if you’re already operating at enterprise scale—and the growth will follow.

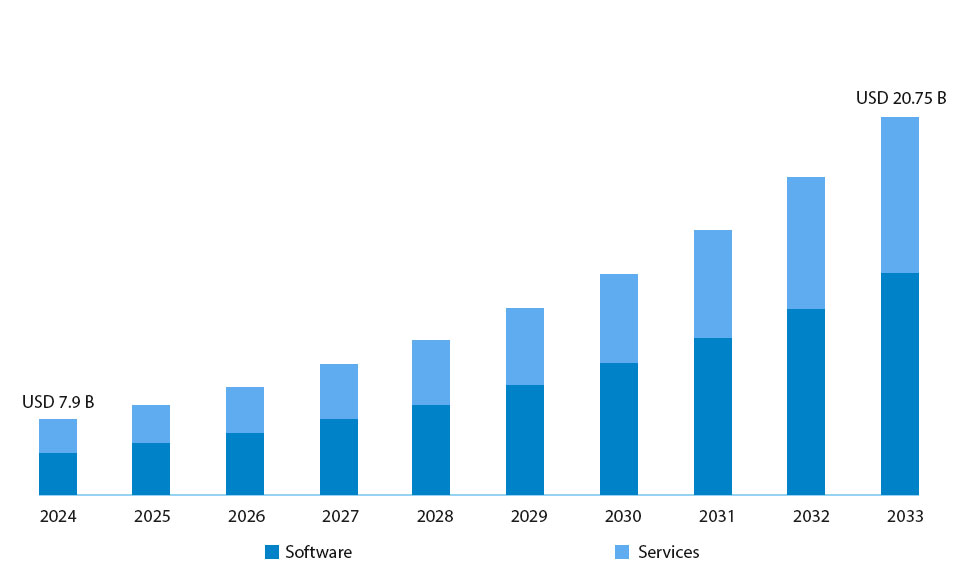

Subscription and Billing Management Forecast. Source: IMARC Group

Further Reading & Industry Insights

If you’re looking to dive deeper into where the subscription economy is heading, recent market research offers valuable perspectives. The Business Research Company outlines key global trends shaping subscription and billing management. Meanwhile, the IMARC Group’s 2024 report highlights how automation, recurring revenue models, and customer-centric strategies are driving sustained growth across industries.

About Novalnet

Novalnet is a global payment service provider headquartered in Germany, specializing in secure, compliant, and scalable payment and subscription solutions for businesses worldwide. We help SaaS providers, marketplaces, and enterprises streamline their operations while staying ahead of global compliance demands.

Antony Robinson is an experienced IT expert, information architect and a customer experience evangelist. He has over 30 years of experience in web technologies, user experience, media, and marketing. Antony is currently the CMO of Novalnet AG, a fintech company in Germany. As CMO, he leads the company’s marketing strategy and fosters collaborations. Antony’s expertise and dedication to technology and innovation make him a valuable leader in his field.