Global Compliance Restrictions

Browse our up-to-date lists of Prohibited and High-Risk Countries and Business Categories. Novalnet follows AML (Anti-Money Laundering) / CTF (Counter-Terrorist Financing) standards and international sanctions. High-risk onboarding is possible after enhanced due diligence (EDD) and approval.

High-Risk Countries

Jurisdictions with elevated AML/CTF risk. Onboarding is case-by-case and requires EDD (Enhanced Due Diligence), sanctions screening, licence checks (where applicable), and ongoing monitoring.

Algeria

Bangladesh

Bosnia and Herzegovina

Bulgaria

Burkina Faso

Gibraltar

Guinea

Indonesia

Iraq

Jamaica

Yemen

Cameroon

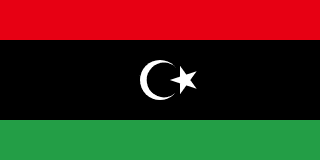

Libya

Mali

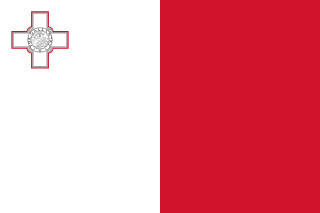

Malta

Mozambique

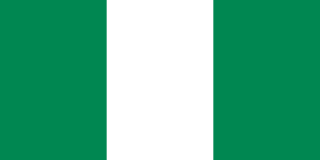

Nigeria

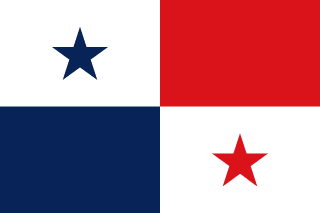

Panama

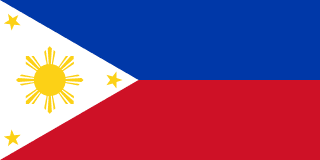

Philippines

Senegal

South Africa

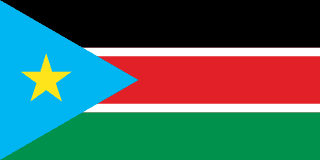

South Sudan

Tanzania

Trinidad and Tobago

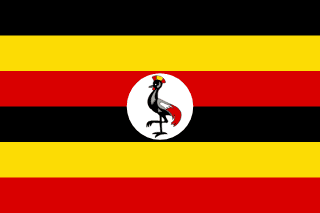

Uganda

Vanuatu

Venezuela

United Arab Emirates

Vietnam

Cyprus

Frequently Asked Questions

Novalnet’s classification of prohibited and high-risk countries based on sanctions, FATF guidance, and AML/CTF rules.

EDD stands for Enhanced Due Diligence – deeper compliance review used for higher-risk customers, countries, or business models. It typically includes stronger KYC/KYB and UBO checks, source-of-funds/wealth evidence, licence verification (where required), expanded sanctions/PEP/adverse-media screening, and ongoing monitoring.

AML stands for Anti-Money Laundering — the laws, regulations, and controls that prevent criminals from disguising the origin of illicit funds. Core elements include KYC/KYB, transaction monitoring, record-keeping, and reporting of suspicious activity.

CTF stands for Counter-Terrorist Financing — measures that detect and disrupt funding of terrorism. It overlaps with AML and relies on sanctions screening, watchlists, blocking/rejecting prohibited transactions, and enhanced monitoring.

To comply with law, prevent financial crime, and meet AML (Anti-Money Laundering) / CTF (Counter-Terrorist Financing) obligations.

Prohibited: no service. High-risk: onboarding may be approved after enhanced due diligence (EDD).

Yes—case-by-case after strict compliance checks, documentation, and approval.

Both. Restrictions apply to entities and individuals located in, operating from, or primarily controlled from restricted countries.

By using UN/EU/OFAC sanctions, FATF evaluations, and internal risk assessments.

A jurisdiction under increased monitoring (often called the FATF grey list) due to AML/CTF gaps.

The FATF black list — jurisdictions with serious AML/CTF deficiencies that may require counter-measures.

Regularly—after changes to sanctions, FATF statements, or internal policy.

Use the official OFAC list search and the EU sanctions portal (plus any local/national lists).

Services must be suspended to remain compliant with international law.

Enhanced KYC/KYB, UBO verification, source-of-funds, proof of business activity, licences (if applicable), and sanctions/PEP screening.

It depends on licence verification, document completeness, and screening outcomes.

Periodic KYC refresh, transaction monitoring, fraud/chargeback controls, reporting, and policy adherence.

Yes—high-risk merchants may face holds, reserves, lower limits, extra reviews, or delayed settlements.

Your MCC describes your business type and influences risk treatment, licensing checks, and pricing.

Visa/other networks run dispute/fraud monitoring programs with thresholds that can trigger remediation or penalties.

Exceeding thresholds may lead to higher fees, reserves, monitoring programs, or termination.

An activity Novalnet cannot support due to legal bans, sanctions, card-network rules, or internal policy.

A sector with elevated AML/CTF, fraud, or chargeback risk—supported only with licensing, EDD, and ongoing monitoring.

See the Business Categories lists: some are prohibited; others are high-risk and require valid licensing and EDD.

Traffic obfuscation is a red flag; use may lead to restrictions or termination for sanctions-evasion risk.

No—sanctions apply across industries. As a regulated provider, Novalnet must enforce them strictly.

Often yes—when transactions touch those jurisdictions, currencies, banks, or persons.

Yes—after sustained compliant behavior, reduced exposure, or regulatory changes.

Depends on the activity and jurisdiction (e.g., gambling, MSB/crypto, lending). Proof of valid licence is required.

Submit supporting documents (licences, ownership, controls) to your Novalnet contact for reassessment.

Yes—the strictest rule applies. Any prohibited country or prohibited activity blocks onboarding.

Blocking holds funds under sanctions restrictions; rejecting returns or refuses the transaction under program rules.

Monitor FATF statements and official sanctions portals; enable periodic re-screening and subscribe to Novalnet compliance updates.