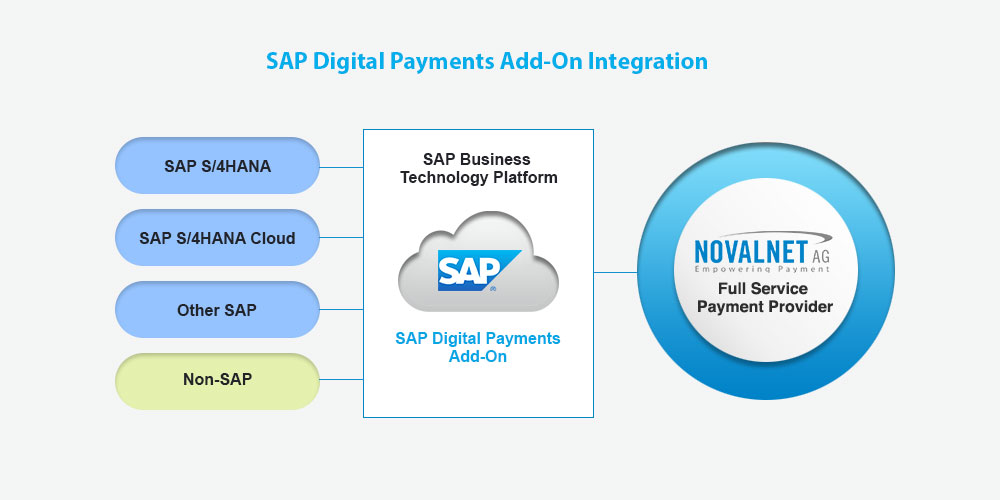

SAP Digital Payments Add-On Integration

Novalnet’s payment module for SAP digital payments add-on equips you with a centralized platform to accept digital payments worldwide, process all transactions in a secure manner and manage all payments through a unified dashboard. Tracking transactions across all sales channels becomes fast and easy, and manual effort invested in invoicing, payouts, billing and more than 15+ other payment services become obsolete.

Quick & Easy Integration

PCI DSS Level1 Security

3D Secure Transactions

Boost Conversion

Feature-rich Admin Panel

Fully Responsive Payment Page

Why Novalnet?

Novalnet’s global payment platform is feature-rich and all-in-one payment facility with the ability to process 150+ payment types in multiple currencies, automation enabled and AI-powered risk management. Payments made through Novalnet lead to a rewarding payment experience that increases your bottom line. Payments just can’t get better anymore.

- A single contract is all you need to receive payments from the word Go

- Enhance checkout experience with features like automated payment selection

- Guaranteed payments & secure escrow accounts maintain your funds safely

- Overall reporting, analytics and data export keeps you well-informed to make the best decisions for your business.

SAP Digital Payment Add-On module Features

- Multiple digital payments are available for your convenience, plus the additional option to choose a digital payment.

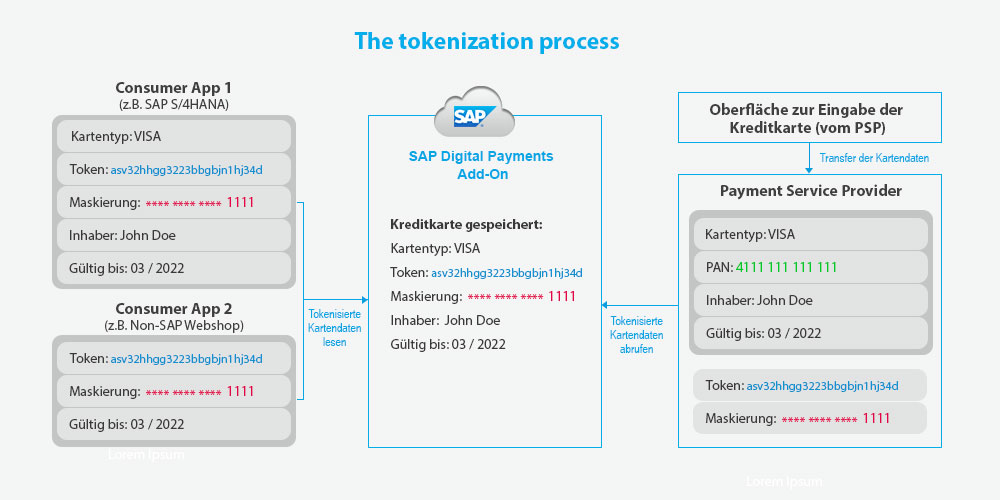

- Secure the sensitive data of credit cards through a special method known as tokenization

- The whole range of business activities from operation to maintenance is managed centrally from one place by SAP.

- No worries about meeting compliance standards anymore, Novalnet ensures PCI DSS (Payment Card Industry Data Security Standard) compliance that is mandatory.

- Out of the box integration facility for SAP and non SAP components to make the integration process much easier.

- The tokenization methodology works well in reducing the cost and avoiding risks.

- Adding a new payment method is fairly easy.

- Enabled automatic allocation and booking of fees and taxes related to payments.

- Automatically reconcile a payment based on the codes and indicator.

- Lower audit costs through this implementation.

- The software is stable for error-free operation with harmonized interfaces for both SAP and non-SAP software.

The SAP Digital Payments Add On integration

Tokenization

The tokenization method utilized helps to hide sensitive data of credit card information during a financial transaction. Rather, simply tokens are exchanged to facilitate a complete payment, a more secure way to execute a payment transaction.

*SAP digital payments add-on as well as the follow-up/consumer applications (e.g. SAP S/4HANA) only store the encrypted data. The credit card numbers remain solely with the Novalnet as the PSP. The tokens are the only identifiers that are processed and stored in the SAP digital paymentsadd-on.

| Created | Novalnet |

| Last Updated | 02.06.2021 |

| Version | 1.0.0 |

| Stability | Stable |

| Language | English (en), German (de) |

| License | Payment Freeware |

| Categories | Payment Gateway |

| Tested Versions | 1.0.0 |

| Compatible Versions | 1.0.0 |

| Download | https://store.sap.com/dcp/en/product/display-2001012298_live_v1/novalnet-solution-for-sap-digital-payments-add-on |

| Version | Date | Description & Changes |

|---|---|---|

| 1.0.0 | 02.06.2021 | - New release |

- Visa

- Mastercard

- American Express

- JCB

- UnionPay International

- Discover

- SEPA Direct Debit

- SEPA Direct Debit with Payment Guarantee

- SEPA Credit

Instalment by SEPA Direct Debit

Instalment by SEPA Direct Debit Direct Debit ACH

Direct Debit ACH- Apple Pay

- Google Pay

- PayPal

- Alipay

- WeChat Pay

- MB Way

Payconiq

Payconiq- Naver Pay

- Samsung Pay

KakaoPay

KakaoPay- TWINT

- Bancontact

- iDEAL

- eps

- Przelewy24

- Diners Club

Blik

Blik- PostFinance

Postfinance Card

Postfinance Card- Trustly

- Online Bank Transfer

- Invoice Payment

- Prepayment

Invoice with Payment Guarantee

Invoice with Payment Guarantee Instalment by Invoice

Instalment by Invoice Instalments

Instalments Barzahlen/viacash

Barzahlen/viacash- Multibanco

- SEPA Online Transfer

- Maestro

- GiroCode

- Swish

Klarna Pay Later

Klarna Pay Later Klarna Instalments

Klarna Instalments- Vipps

- MobilePay

- Satispay

- Paysera

- Paysafecash

- Ovo

- Neteller

- Grab Pay

- FPX

Coopeuch

Coopeuch Corpbanca

Corpbanca DOKU

DOKU- MyBank

- Santander

- TrustPay

Verkkopankki

Verkkopankki- Santander Mexico

Rapipago

Rapipago- PaysafeCard

- Pago Fácil

- OneCard

Konbini

Konbini Cash on pickup

Cash on pickup Bitpay

Bitpay Bank Transfer (TEF)

Bank Transfer (TEF) 7 Eleven Bill Pay

7 Eleven Bill Pay- Amazon Pay

- Skrill

Klarna

Klarna Surtimax

Surtimax Singpost

Singpost- Sencillito

- Redpagos

Provincia NET

Provincia NET Mobile Payment

Mobile Payment Empresa de Energia

Empresa de Energia Efecty

Efecty Direct Carrier Billing

Direct Carrier Billing- Davivienda

Carulla

Carulla Boleto Bancário

Boleto Bancário- BBVA Bancomer

- Banco de Chile

- Banamex

Baloto

Baloto- Qiwi

Paysbuy

Paysbuy- paydirekt

- Yandex

- Webpay

- SPEI

- Banco Santander

- SafetyPay (LATAM)

RHB Bank

RHB Bank- POLi

Pagos Seguros en Línea

Pagos Seguros en Línea- Pago Efectivo

- Oxxo

- MyClear FPX

Klap (FKA Multicaja)

Klap (FKA Multicaja) Maybank2u

Maybank2u- Iyzico

- Itaú

eNETS

eNETS Dragonpay

Dragonpay- CIMB Clicks

- Bradesco

- Banco do Brasil

AstroPay Direct

AstroPay Direct AmBank

AmBank Affin Bank

Affin Bank Tarjeta Shopping

Tarjeta Shopping- Servipag

- Presto

- postepay

- PayU

- Nativa

Naranja

Naranja- Magna

- Hipercard

- Elo

- dankort

- CMR

Cencosud

Cencosud CartaSi

CartaSi Cartao Mercado Livre

Cartao Mercado Livre Carnet

Carnet Cabal

Cabal Aura

Aura AstroPay Card

AstroPay Card Argencard

Argencard- Direct Debit UK (BACS)

Paytrail

Paytrail Cartes Bancaires

Cartes Bancaires