Digital payments have exploded, driven by greater internet penetration, growth in e-commerce, and a greater willingness from consumers and businesses to use them. But with this, online fraud has increased as well. In 2021, e-commerce fraud in Europe surged by 350%. CMSPI estimates that merchants in Europe spend nearly €7 billion a year on fraud prevention. One thing is clear: fraud is bad news. That is why all merchants need to perform payment authentication to prevent fraud and protect their customers.

So, what is Payment Authentication?

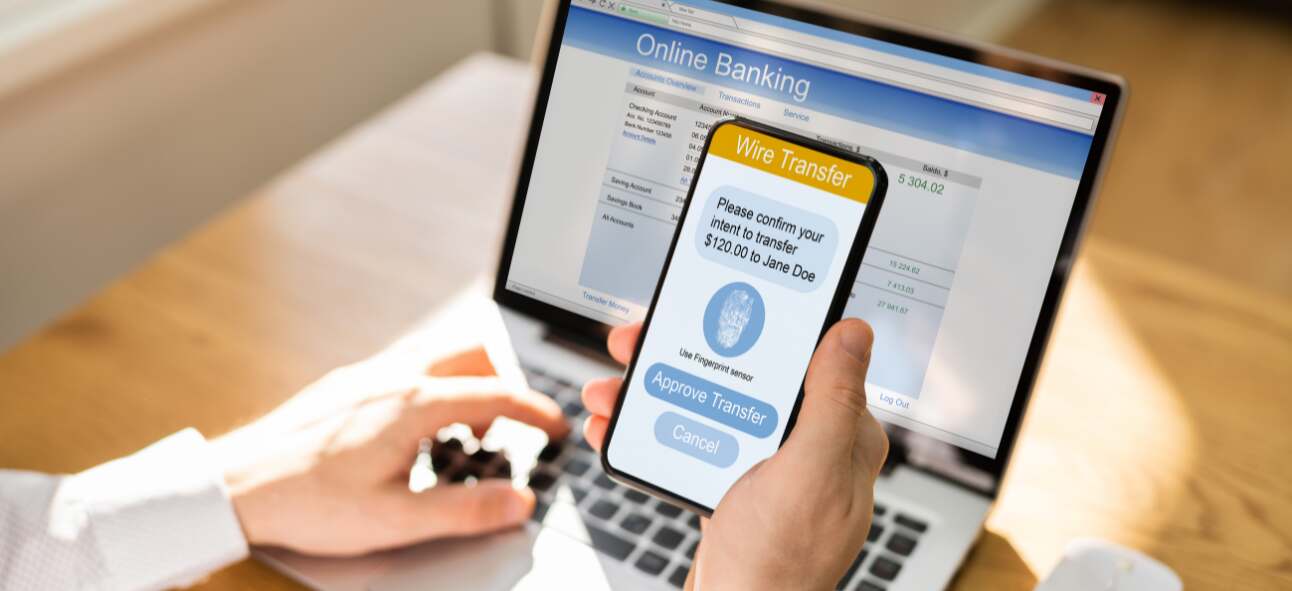

Payment authentication is the process of confirming a customer’s identity and ensuring their payment info and personal data isn’t being used to commit fraud without their knowledge. Banks, merchants, and payment processors use a combination of authentication factors to protect from fraud and chargebacks. One-time passcodes, biometric scans, and challenge questions are some common methods used to confirm a buyer’s identity and confirm payments from their account or card.

Why do you need Payment Authentication?

Proper payment verification is essential to protect consumers and your business from fraud. This means you need to ensure that a person making a payment is the genuine customer. Verifying a payment and authenticating the customer helps a merchant to protect customer data and ensure payments are secure. Consumers today expect brands to protect their data. They expect brands to take all necessary steps to ensure their payments and data is safe from hackers and unauthorized use.

Effective payment authentication follows newer ID security standards such as 2-factor authentication and uses biometrics that are specifically designed to secure online payments. People are no longer required to navigate multiple steps, remember passwords, or deal with elaborate steps.

What is SCA and Why is it Important for Your Business?

Strong Customer Authentication or SCA is a European regulatory requirement under the EU Revised Directive on Payment Services (PSD2). It aims to reduce payment fraud and keep customers safe, while ensuring a smooth and seamless payment process. Verification is based on at least two or three factors such as:

- Something a person knows, for e.g., a PIN or a one-time password (OTP),

- Something the person has, for e.g., a card or phone,

- Something a person is, such as a biometric scan (fingerprint/iris/voice, etc.).

SCA applies to all bank transfers, card payments, and other forms of online payments.

SCA requirements came into effect in Europe on 1 January 2021, and in the UK from 14 March 2022. SCA requirements are now fully implemented in all countries within the European Economic Area. All businesses in the EU and UK are required to apply SCA to all digital payments, as an extra security layer.

Learn more:2-factor Authentication and PSD2 in Europe: What Merchants Need to Know

What is 3D Secure 2.3 And Why Do Merchants in Europe Need to Use It?

How the Right Authentication Process Helps Increase Conversions

Increasing the conversion rate is a primary goal for most businesses. A seamless authentication process is necessary because it is a vital part of the shopper’s journey. Authentication helps a business to verify if a user is genuine or not. It offers security and a seamless user experience. It can contribute to strengthening your customer’s trust and confidence in your brand, and in turn, boost your business’s ROI and conversion rate.

Here’s a look at how efficient payment authentication helps increase conversions:

1. Keeps Payments Safe from Fraud

With the surge in e-commerce and greater use of digital payments, there has been a rise in fraud cases. Fraud losses were estimated to be at USD 41 billion globally, in 2022. This figure is expected to grow further in 2023. For e-commerce businesses, especially new and growing ones, thorough payment verification is key to prevent fraud. Hence, the need for proper Know-your-customer (KYC) processes and Strong Customer Authentication (SCA).

These methods provide access to accurate data in real-time, making it easier to identify genuine clients and block fraudsters with greater accuracy. This makes the entire payment process hassle-free and leads to a more satisfactory and smooth customer experience. When your payments are fully secure, you win customer trust and their loyalty. This, in turn, boosts your brand reputation and drives conversions, from repeat as well as new customers.

2. Helps in Data Protection and Privacy

Keeping payment data secure is vital for all businesses. Implementing SCA to meet PSD2 requirements helps a business deploy high-level security and authentication to the payment process. This adds an extra security layer and allows secure and data sharing between merchants, payment networks, and financial institutions, and help them properly verify a customer’s identity with absolute confidentiality.

This ensures bad actors cannot pass off as a genuine customer, because only the real customer will have access to the correct info for successful authentication. When customers know and trust that you are keeping their data secure and private, they will be more willing to shop with you, time and again.

3. Helps Meet Regulatory Compliance

Businesses operating in the EU or planning to expand to new markets within the EU have to comply with specific data protection regulations. This includes the revised Payments Services Directive or PSD2. Using the strong customer authentication processes helps a business remain compliant with PSD2. This will help you create a better and more secure online platform for your customers, while ensuring you are not falling foul of regulators.

Working with an experienced PSP like Novalnet helps ensure that your business meets the SCA requirements and stays compliant with other local laws. The right partner can help you track local trends and changes to laws and regulations, and help you create the best payment experience. This, in turn, will have a positive impact on your brand image and boost conversions.

4. Improves the User Experience

Payment authentication requires granular customer data. The richer the data, the faster the authentication and shorter the checkout time. Using strong customer authentication helps a brand create a consistent and smooth UX as it replaces weak passwords with stronger multi-factor authentication measures like biometrics, OTPs, etc. This speeds up the entire payment process and builds more trust and confidence among customers around online transactions.

More granular payment data also gives a business meaningful insights and helps it understand its customers better. This, in turn, helps them create a more intuitive UX for customers. Data also helps to fight fraud and create a seamless payment experience. Customer loyalty is based on trust and consistency. When customers are authenticated quickly every time they make a transaction, they are more likely to keep shopping from you. Also, when customers have greater control over what data they share and how, they are more likely to trust your brand. And this, creates room for higher conversions.

How can Novalnet Help?

We can help you set up Strong Customer Authentication for your business. As a global PSP, we have deep experience in helping Europe’s leading brands process their payments. Our state-of-the-art technologies and methods help businesses across Europe to accept payments globally and stay compliant with all laws and regulations. From our instant payment plug-ins to our AI-based risk management tools, we have the resources to get you up and running in a short time, and with zero hassle.

Reach out to us today to know more about how we can help your business.

Gowri Shankar is the IT Application Security Manager at Novalnet with versatile knowledge in Programming and System/Security architecture. Having 11+ years of experience in the financial services industry, Cybersecurity, Payment Card Industry Data Security Standard (PCI DSS). Certified in Advanced Payment Card Industry Security Implementer (CPISI 2.0), Secure Software Lifecycle Professional (CSSLP) from (ISC)².