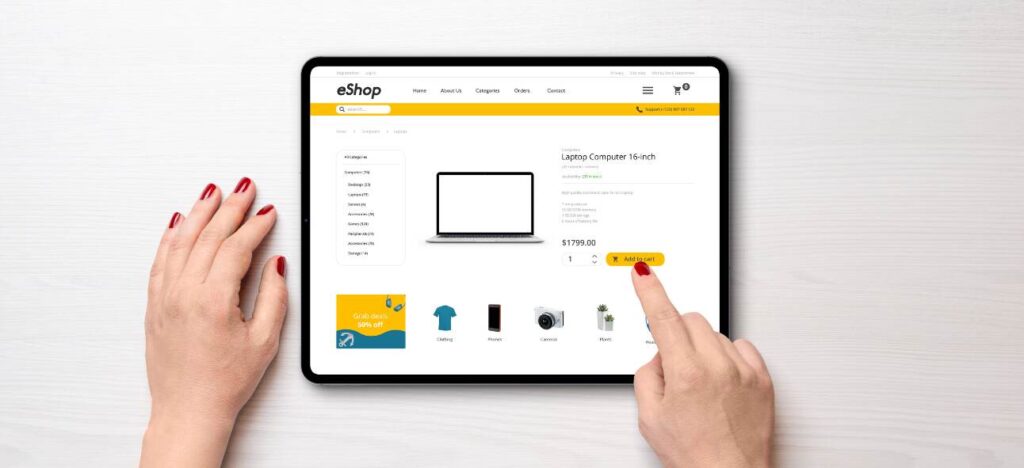

Digital payments have exploded, bringing convenience and flexibility to everyone’s fingertips. Even in Europe, a traditionally cash-loving continent, online payments are everywhere, having picked up rapidly since the pandemic. It is a fascinating puzzle really. But getting the pieces right is essential. With so much innovation happening, it can get confusing, and staying updated on what’s new can be quite a task. Hence, having a payments strategy helps you to track and test how your digital payments are performing. And more importantly, how you can make payments strategy better. In this blog, we lay out six tips to help you design a competitive payments strategy.

1. Tap into Payments Data

Your payments data contains a wealth of information on your customers’ shopping habits – from what they like to how they like to pay and when. Tapping into this data can help you understand your customers better and gain insights. These insights help you offer more personalized products to your customers and prompt support when they need it. This helps you deepen engagement with your customers and design the best checkouts.

Analysing payment data also helps you track your sales, cash flow, and revenue. You can monitor the health of your business and plan your growth. This gives you better control over operations and your business. In short, look at your payments data to get a better understanding of what is working and what is not.

Also read:

How Data and AI Improve Your Payments

Why Payment Analytics is Good for your Brand

2. Leverage Real-Time Payments

Real-time payments are instant payments (for example, account-to-account transfers) made via payment networks and are available 24×7 round the year. Adopting real-time payments helps you move money faster between accounts. Its quick, simple, and secure. This helps you settle payments on time, especially cross-border ones. On the other hand, consumers love the fact that these payments are fast, secure, and contactless, thus pushing their adoption in Europe.

The rise of open banking and newer messaging standards such as ISO 20022 are making real-time payments a reality in Europe. Currently, the SEPA Instant Credit Transfer (SCT Inst) in the EU, and Faster Payments in the UK, are the active RTP systems in the region. Nordic’s P27 network is expected to go live in 2022.

3. Optimize Cross-Border Payments

If you sell to customers across Europe (and the world) you need to beef up your cross-border offerings to make international payments secure and easy. This means making cross-border payments as easy and frictionless as domestic ones. Not only does it help you widen your reach, it also helps you build up a loyal base.

Hence, make sure your payments have as less friction as possible. This means supporting local payment methods and currencies, banking with local acquirers, and reducing payment declines. You also need to be compliant with all local laws (for example, PSD2 in Europe) to keep such payments secure. Work with a global PSP like Novalnet to easily accept cross-border payments. This is easier than setting up local offices or bank accounts in all the different markets you are in.

Also read: How to increase payment acceptance rates in cross-border e-commerce

4. Use Embedded Payments

Customers today demand quick and convenient checkouts. Hence, embedding payment methods in the checkout journey helps you reduce friction and create a smooth user experience. It also helps you offer greater personalization. Harness customer data to offer relevant, contextual financing options at the point of purchase to reduce friction and improve conversion. They also minimize your processing costs and ensure the shopper has a hassle-free experience.

5. Adopt AI-Driven Payments

AI-based payment systems can make your entire checkout and payments process intuitive and smooth. They improve CX, boosts loyalty and improves retention. These systems help you to analyze user behaviour patterns – from browsing to payment history. You can monitor threats and fraud in real-time and ensure payments are secure. Automating your payment system will also help you to avoid late payments, send personalized payment reminders, and streamline your debt collection process.

With automation, you can reduce manual labor, save time and costs, and make processes more efficient. AI and machine learning tools help you analyze data from across functions – from sales to payments to CRM – to gain insights that help you take better decisions. More efficiency also means better performance and lower opex.

6. Prevent Payments Fraud

Protecting your business and customers from fraud must be your top priority. You must use best-in-class fraud prevention measures to secure payments and be seen as a trustworthy brand. AI-based risk management tools can help you track fraud in real-time. These tools help you monitor large volumes of complex payment data in real-time. They analyze data from varied sources and correlate them to detect fraud. These algorithms use a continuous feedback loop to constantly improve their ability to detect newer fraud patterns. You can customize these tools to your business and set up optimum fraud rules. A robust fraud prevention setup also improves payment acceptance rates and the user experience.

You might like: Payment Fraud and Brand Loyalty

How can Novalnet Help You Desgin a Payments Strategy?

We are a global PSP who are trusted advisors to Europe’s leading brands when it comes to payments. Our state-of-the-art technologies and methods help businesses in Europe accept payments globally. From our instant payment plug-ins to our AI-based risk management tools, we have the resources to get you up and running with your payments in a short time, and with zero hassle.

Reach out to us today to know more about how we can help your business.

Jose Augustine is the Chief Business Development Officer at Novalnet with extensive experience in European payment industry and a knowledge powerhouse.